Our Solutions

Loan Monitoring.

While banks are facing a problem of mounting NPAs, monitoring bank transactions of large borrowers has become an important and onerous part of bank audits. Transaction analysis is the first line of defense against fund diversion. However, auditors find this task challenging due to the huge volume of transactions. A quarterly audit might involve analyzing thousands of transactions for a single loan account. To add to the difficulty, the transactions are written in many different ways, making it impossible for simple rule-based solutions to automate this task.

Dtect LM is a great solution for your transaction analysis needs. Due to its roots in AI and ML, it is highly capable of analyzing bank statements despite the variations. Specially designed for lenders, auditors and Agencies for Special Monitoring (ASM’s), Dtect LM provides all the metrics that you require for loan account audits. Its availability as SaaS ensures that you get an end-to-end, reliable solution without any investment in IT infrastructure.

how it works

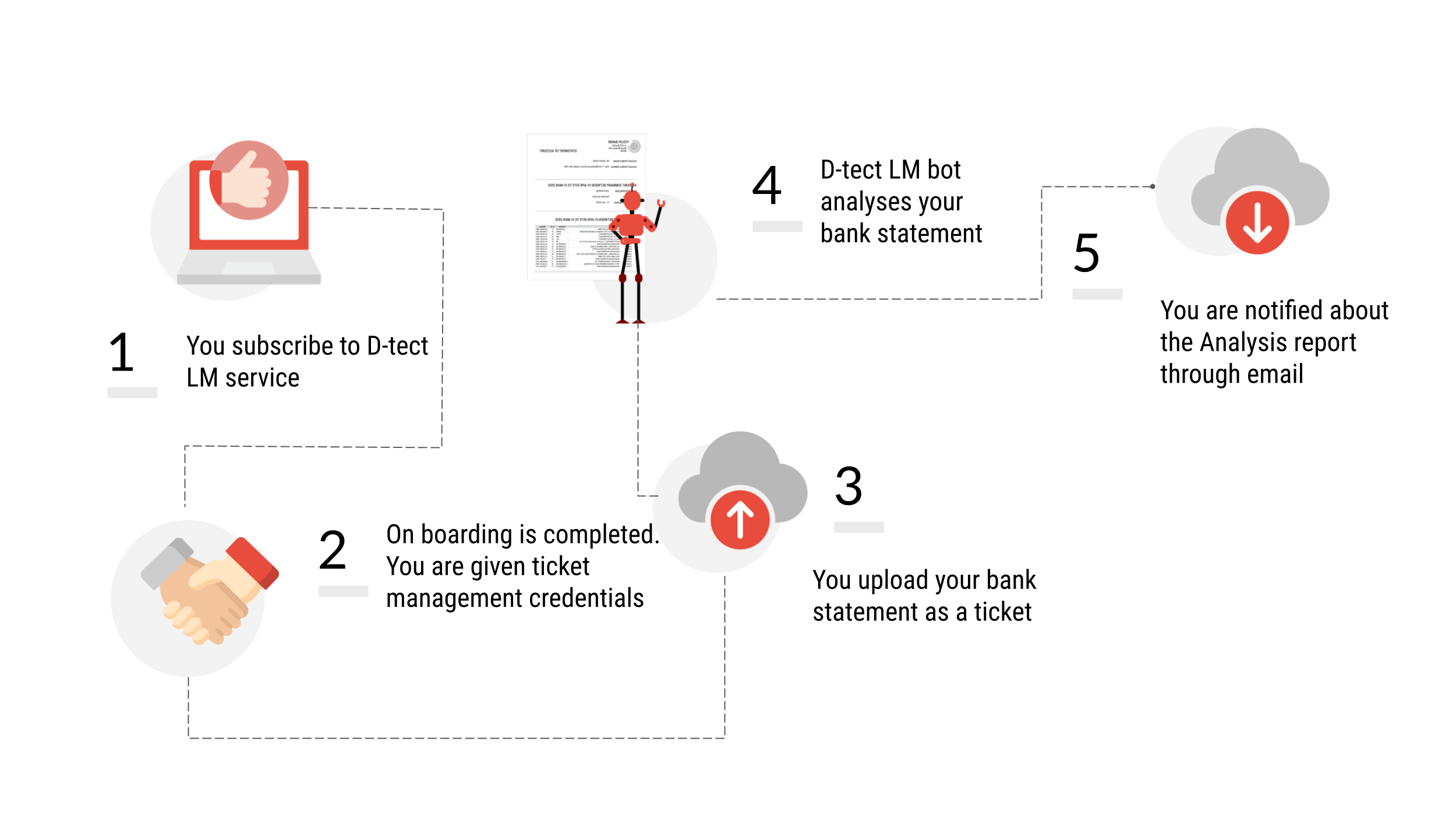

process flow.

It is quite simple to use Dtect LM for analyzing your bank statements. Once you are onboarded as a client, you have to create a ticket in an easy to use website and attach the file you want to be analyzed. The statement is analyzed using an AI bot. The result is checked for any inaccuracies by a competent human resource. Once the analysis is ready, you get a notification by email. You can then download the analysis result from the same ticket as an MS Excel® sheet.

What it does

features.

The versatile reader

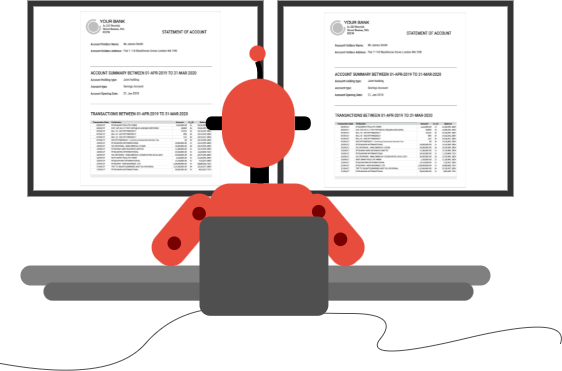

One of the big challenges of loan monitoring is the large volume of transactions. A moderately sized statement can contain more than 1000 transactions. The Dtect LM bot processes even large statements in seconds, leaving enough time for cross-checking by human eyes. The unique CLA method implemented by the Dtect bots enable drastic reduction of cross-checking time, thus achieving a low Turn-around-time (TAT) for your complete and accurate analysis.

The Dtect LM bot is very good with tasks like matching, comparing and reconciling. These skills come handy when you need comparison of transactions that happened in two different times, often a good indicator of a change in behavior.

Another of the Dtect LM bot abilities, based on its AI foundation, is to identify patterns and ignore small variations. In a bank statement, the narrations contain many variations. For example, the name of the same party is written in many different ways. Dtect LM can see through this and present an accurate consolidation of such transactions.

The Metrics

The transfer of money to certain types of companies, for example a real estate company, is an indicator that Agencies for Special Monitoring (ASMs) take seriously.

Is the bank loan being utilized to optimum level? If it is lying unutilized, the auditor would want to know.

Similar transactions occurring frequently is a phenomenon that catches the attention of an alert auditor in an Agency for Special Monitoring. Dtect LM brings this to the surface.

What should be considered as ‘high value’? Statistical inference is required to correctly identify them.

A lot of scenarios become clear to the auditor once the map of party wise transactions is made available to the auditor. This is one of the major metrics that Dtect LM brings forth.

Easy to use

While it is possible to deploy Dtect LM on your own server, the Agencies for Special Monitoring (ASM) are usually not prepared to spend on IT infrastructure and management. The availability of Dtect LM as Software as a Service (SaaS) means that no such investment is required. The ASM’s can start immediately, without any upfront investment.

Once you register, you get a trial period of 15 days to try the Dtect LM service. The Agencies of Special Monitoring can try processing the statements of their clients to check if the analysis is as per their need. After the trial period ends, you are charged only for the statements that are processed. For larger volumes, slab and bulk rates are also available.

We have a team of Chartered Accountants that examine the results for correctness. This means that the analysis you get is immediately usable, saving your invaluable time. While no analysis output can be 100% accurate, we ensure that no important point is in error.

Frequently Asked Questions

faq.

Dtect LM can currently process digital PDFs, CSV and text files. We are soon releasing the capability to process scanned PDFs.

The Turn-Aroun-Time (TAT) of the service depends on factors such as the type of the file and the number of transactions. Soon after you submit the bank statement, your ticket is updated to inform you of the expected time to complete. The time can vary from a few minutes to an hour.

The bank statements are processed by an automated system called a ‘bot’. A bot is a complex software that is based on Artificial Intelligence and Machine Learning. The bots are trained with large amounts of past data so as to be good at their work. The bot outputs are checked for major errors by an expert human resource.

The Dtect LM SaaS includes validation of the output of the bot by an expert person. This eliminates the possibility of simple mistakes in the output.

We keep the analysis results for a certain period of time that is part of your agreement. After this period, the results are deleted from our side and are no longer available.