Our Solutions

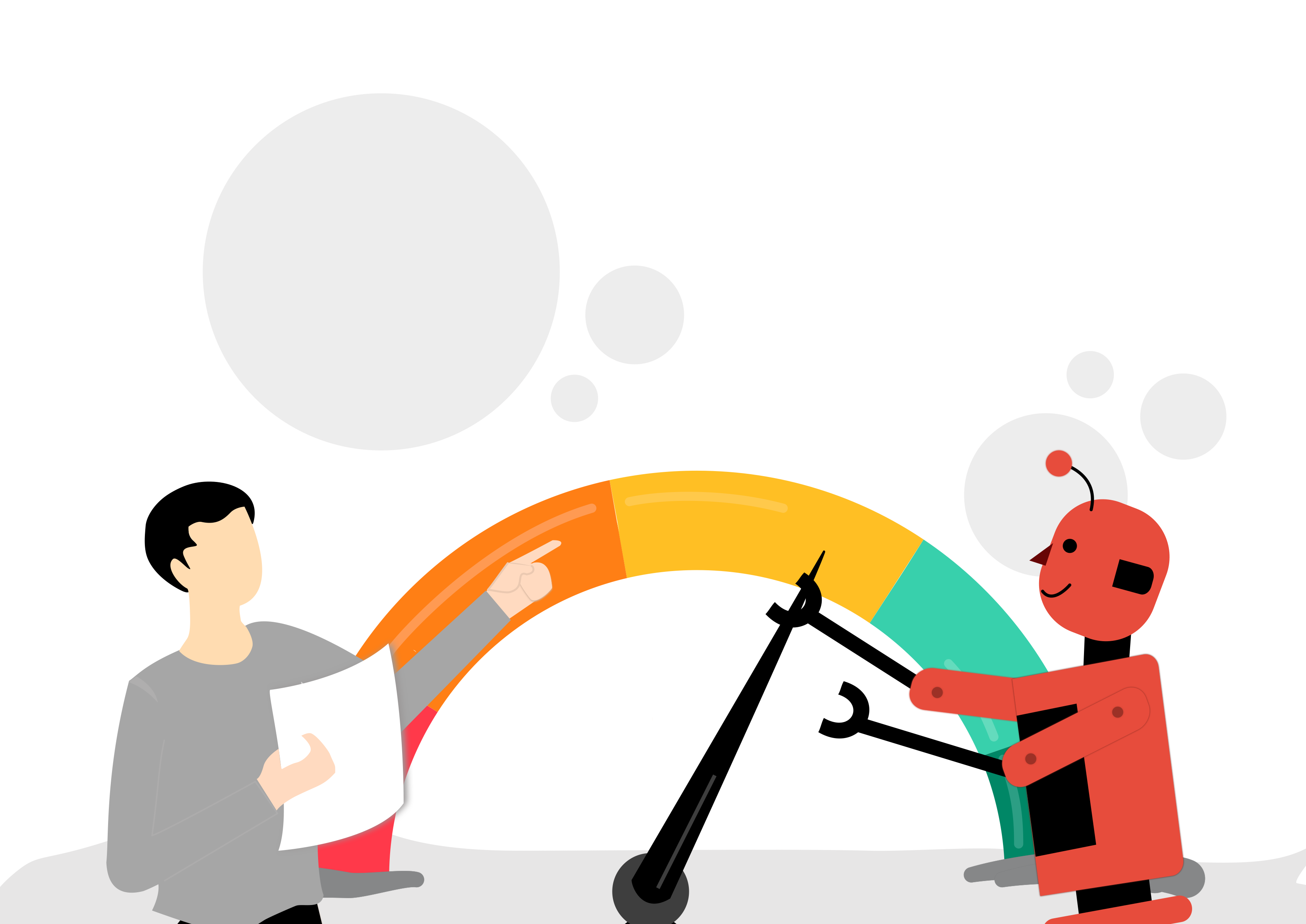

Credit Assessment.

Credit Assessment is an important process in the financial services industry. A lender conducts credit assessment to verify whether the borrower has the capability to pay back the loan. The process involves gathering of information (usually from documents), computation and finally the assessment. The credit industry has undergone huge changes in the last few years. The speed at which loans are approved has accelerated so much that decisions are being taken in minutes. This has led to the introduction of automation in the assessment process. In fact, with more and more applicants resorting to online applications, assessment is done in real time so that instant offers can be made to the prospective borrowers.

Automation of credit assessment is difficult to implement, however. The unstructured nature of the data and involved decisions make it hard to offer an effective solution to the problem. Dtect is ideally suited for this task. With its formidable unstructured data processing and decision making capabilities, automated credit assessment using Dtect proves to be a boon to lenders such as banks, NBFCs and fintechs. The instant credit assessment capabilities of Dtect are also leveraged well by loan aggregators.

What it does

features.

The unique proposition

The Dtect iCA bot can process all the documents of an applicant that affect the credit assessment. For example, it accepts bank statements, salary slips. Form-16 and Credit Bureau Report for a salaried person. The results are thus corroborated by more than one source.

Dtect iCA can process all these documents in less than 10 seconds. This is why it is ideal for online applications and offers. It takes a little more time (but still less than 2 min) to produce a comprehensive report for the credit team.

The quick output produced by the bot is used for integration with your onboarding or application system. The bot also produces another output for the use of your credit team. This is a novel and interactive dashboard giving the parameters, Alerts and Insights from the documents. The credit team members find this enormously useful.

Metrics

This is the total of all earnings of the person, such as salary, bonus and incentives, rent and so on.

Typically the repayments of existing loans. Together with the income, this decides the loan amount that can be sanctioned.

Alerts highlight the financial behavior of a person. They include items such as check bounces, any exceptional withdrawals, possibility of other bank accounts and so on.

These are hints that can be utilized by the credit team for improving the sanctioned amount. A good example is the investments of the applicant.

Easy to use

While it is possible to deploy Dtect iCA on your own server, many organizations are usually not prepared to spend on IT infrastructure and management. The availability of Dtect iCA as Software as a Service (SaaS) means that no such investment is required. You can start using iCA immediately, without any upfront investment.

Once you register, you get a trial period of 15 days to try the Dtect iCA bot. You can try processing the documents of your clients to check if the analysis is useful. After the trial period ends, you are charged only for the documents that are processed. For larger volumes, slab and bulk rates are also available.

In most cases, Dtect iCA will be integrated with your website or mobile app. This is quite easy because iCA is available as a Rest API, the simplest way of integration between systems.

how it works

process flow.

.png)

The process flow for Dtect Credit Assessment has been designed to work seamlessly with your existing systems. You can use it simply as a SaaS or can even use our API based integration for on premise installations.